Your cart is currently empty!

Category: Money Management

-

Simple Credit Card Payoff Calculator

Ready to see exactly how long it’ll take to become debt-free?

Find out in 3 EASY STEPS with our simple Debt Payoff Calculator.

Enter your amounts below.

Step by step instructions here

Example here

Extra Payoff Tips here

How To Use Out Credit Card Payoff Calculator

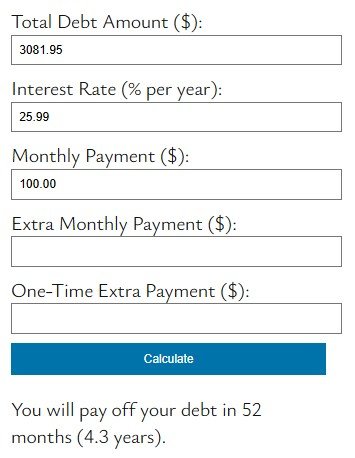

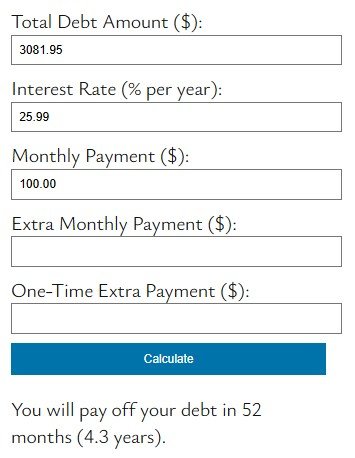

Step 1: Enter Your Current Debt Details

- Total Debt Amount ($) – Enter how much you currently owe.

- Interest Rate (% per year) – Enter your loan or credit card’s annual interest rate.

- Monthly Payment ($) – Enter what you currently pay each month

Step 2: Add Extra Payments (Optional)

- Extra Monthly Payment ($) – If you plan to pay an extra set amount each month, enter the additional amount here.

- One-Time Extra Payment ($) – If you have a lump sum (like a bonus or tax refund) to put toward your debt, enter that amount here.

Step 3: Calculate Your Payoff Time

- Click the “Calculate” button.

- The calculator will display an estimate of how many months it will take to pay off your debt.

- If your payment is too low to ever pay off the debt, the calculator will alert you to increase your monthly payment.

Example

- Debt Amount: $3081.96

- Interest Rate: 25.88%

- Monthly Payment: $100

- Extra Monthly Payment: $0

- One-Time Payment: $0

Click Calculate and it will calculate that you will pay off your debt in 52 months (4.3 years).

Tips for Faster Debt Payoff

- Increase your monthly payment to reduce interest.

- Make extra payments whenever possible.

- Use lump sums (like bonuses or tax refunds) for one-time extra payments.

Try different scenarios to see how extra payments can help you become debt-free faster!

A Friendly Note About Our Resources

While I’m passionate about helping you take control of your finances, I want to be clear that I’m not a financial advisor, consultant, or guru. The tools, calculators, and resources on this site are based on my personal experience and what has worked for me in my own financial journey.

Please use all resources, calculators, and downloadable items as guides to support your financial decisions, not as professional financial advice. Every financial situation is unique, and what works for one person may not work for another.

I encourage you to reach out if you have:

- Questions about how to use our tools

- Suggestions for making them more helpful

- Feedback about your experience

- Ideas for new resources

For major financial decisions, please consider consulting with a qualified financial professional who can provide advice tailored to your specific situation.

Your success matters to me, and I’m here to support your journey toward financial confidence!

-

Home Renovation Project Plan Template Excel Spreadsheet

Home Renovation Project Plan Template Excel Spreadsheet

Renovating your home can feel both exciting and overwhelming, right? We get it—it’s a big undertaking and can sometimes be exhausting. But your home is where life’s most cherished moments happen, making it all worthwhile. To make your renovation journey smoother, good planning is essential. With so many details to manage, our home renovation spreadsheet is here to help you stay organized and on track.

Let’s get into all the features this home renovation spreadsheet has to offer!

Home Renovation Spreadsheet Template

With our Home Renovation Project Plan Template, you will be able to keep track of all the moving parts for your entire home or entire project like a kitchen remodel or bathroom remodel.

When you use our template, in an instant you’ll:

- See a complete list of all phases

- Use the gantt chart to see the entire project scope

- What needs to be completed that is contingent on another project phase

- Budget planner

- Invoice

- Contractors and contact information

- Tracker spreadsheet

- Current phase of the project

- Completed projects

Benefits of using a spreadsheet template for your home renovation

Renovating your home can feel both exciting and overwhelming, right? We get it—it’s a big undertaking and can sometimes be exhausting. But your home is where life’s most cherished moments happen, making it all worthwhile. To make your renovation journey smoother, good planning is essential. With so many details to manage, our home renovation spreadsheet is here to help you stay organized and on track.

Let’s get into all the features this home renovation spreadsheet has to offer!

Home Renovation Spreadsheet Template

Home renovations can come with their fair share of challenges, but with the right planning, many of these issues become manageable. Here’s how a home renovation spreadsheet can make the process smoother and more efficient while keeping everything in one place:

1. Manage Your Entire Renovation in One Place

Track every aspect of your renovation—budget, materials, timelines, and more—all in one convenient and accessible spreadsheet. Say goodbye to scattered notes and hello to an organized process.

2. Customize the Template to Fit Your Needs

Every renovation is unique, and so is your process. With a customizable home renovation spreadsheet, you can tailor the template to match your specific project needs, providing you with the flexibility to work your way.

3. Save Time

No more juggling pen and paper or dealing with overly complex software. This spreadsheet streamlines your workload, helping you track expenses, timelines, and progress in one place. Plus, built-in formulas allow for quick and easy cost calculations, saving you time and effort while keeping you within budget.

4. Cost-Effective Solution

Why invest in expensive apps or software when renovations are already costly? This spreadsheet template offers a budget-friendly alternative, giving you all the functionality you need without the added expense.

5. Simplify the Process

Using a smart online spreadsheet doesn’t just keep things organized—it makes the entire renovation process more enjoyable. Spend less time managing the logistics and more time choosing paint colors, fixtures, and designs you’ll love.

Make your home renovation process stress-free and efficient with the help of this comprehensive spreadsheet solution!

Getting started with the home renovation spreadsheet template

Frequently asked questions

-

Cash Flow Template for Income, Debt, and Living Expenses for Financial Success

Ever looked at your bank account and thought ‘Where did my money go?’

You’re not alone.

Taking control starts with understanding your income, debt, living expenses, and cash flow.”

I’ve created a Free Cash Flow Sheet to guide you step-by-step.Understanding Income

Income is the total amount of money you receive on a regular basis, typically monthly, from various sources. It represents the money flowing into your personal or household finances, which you use to cover expenses, pay down debt, and save for the future.

Types of Income

- Earned Income: Money you make from working a job, including wages, salaries, and tips.

Example: Your paycheck from a full-time job. - Side Hustle Income: Money from part-time jobs or freelance work.

Example: Running a small Etsy shop or freelancing. - Passive Income: Money earned with minimal effort, like rental income, royalties, or dividends.

Example: Earning from renting out a property or stock dividends. - Other Income: Additional sources such as bonuses, child support, alimony, or government benefits.

Example: Social security payments or unemployment income.

Why Income Matters

Your income is the foundation of your budget. Without a clear understanding of how much money is coming in:

- You can’t effectively plan your expenses.

- You risk overspending, leading to debt accumulation.

- You miss opportunities to save and invest for the future.

Pro Tip: Track all your income sources, even the smaller ones! Every dollar counts toward achieving financial freedom.

Not Sure How to Track Your Income?

Download my free Cash Flow Sheet to list your sources and see your total earnings.

Managing Debt

Debt is the money you owe to lenders, creditors, or financial institutions. It represents obligations that must be repaid over time, often with interest, and can include loans, credit cards, and other liabilities.

Types of Debt

- Secured Debt: Debt backed by collateral (something the lender can take if you don’t pay).

Example: Mortgage or auto loan. - Unsecured Debt: Debt not tied to any collateral.

Example: Credit card balances or personal loans. - Revolving Debt: Debt with a credit limit that can be borrowed, repaid, and borrowed again.

Example: Credit cards or lines of credit. - Installment Debt: Debt repaid in fixed amounts over a set period.

Example: Student loans or car payments.

Why Debt Matters

Debt can quickly become overwhelming if not managed properly. Ignoring your debts can lead to:

- High-interest charges that grow your balances.

- Difficulty saving money or achieving financial goals.

- Damaged credit scores, making future borrowing more expensive.

Pro Tip: List all your debts with their balances, minimum payments, and interest rates. This helps you create a clear plan for repayment.

Ready to Take Control of Your Debt?

Download my FREE Cash Flow Sheet to organize your debts and take the first step toward financial freedom.

Breaking Down Living Expenses

Living expenses are the essential costs required to maintain your day-to-day life. These include everything you spend on housing, utilities, food, transportation, and other necessities that keep your household running.

Types of Living Expenses

- Housing Costs: Rent, mortgage payments, property taxes, and home insurance.

Example: Monthly rent or mortgage of $1,200. - Utilities: Bills for electricity, water, gas, internet, and phone services.

Example: Electric bill of $150. - Groceries and Food: Money spent on groceries, dining out, or meal subscriptions.

Example: $400 monthly for groceries. - Transportation: Costs for car payments, gas, public transportation, or rideshare services.

Example: $300 for gas and car maintenance. - Other Necessities: Clothing, healthcare, insurance, and childcare expenses.

Example: Health insurance premiums of $200.

Why Living Expenses Matter

Living expenses make up the largest part of most budgets. If you’re not tracking them:

- You might spend more than you earn without realizing it.

- Small, unnecessary expenses can add up over time.

- You’ll struggle to find areas to cut back and save money.

Pro Tip: Categorizing your living expenses helps you see where your money is going and identify opportunities to save.

Take Control of Your Living Expenses

Track your spending, spot possible savings opportunities, and start living within your means!

“Balancing income, debt, and expenses doesn’t have to be overwhelming. By organizing these three areas, you’ll feel more in control of your finances and start making real progress toward your goals.”

“Ready to take the first step? Download my free Cash Flow Sheet and start balancing your budget today!” - Earned Income: Money you make from working a job, including wages, salaries, and tips.