Your cart is currently empty!

Simple Credit Card Payoff Calculator

Ready to see exactly how long it’ll take to become debt-free?

Find out in 3 EASY STEPS with our simple Debt Payoff Calculator.

Enter your amounts below.

Step by step instructions here

Example here

Extra Payoff Tips here

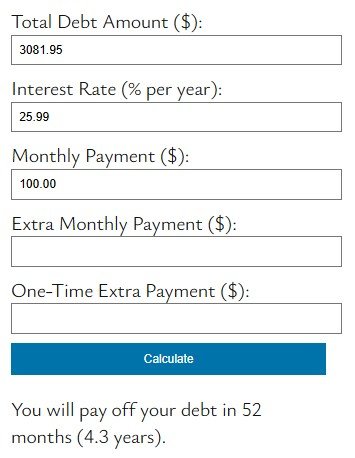

How To Use Out Credit Card Payoff Calculator

Step 1: Enter Your Current Debt Details

- Total Debt Amount ($) – Enter how much you currently owe.

- Interest Rate (% per year) – Enter your loan or credit card’s annual interest rate.

- Monthly Payment ($) – Enter what you currently pay each month

Step 2: Add Extra Payments (Optional)

- Extra Monthly Payment ($) – If you plan to pay an extra set amount each month, enter the additional amount here.

- One-Time Extra Payment ($) – If you have a lump sum (like a bonus or tax refund) to put toward your debt, enter that amount here.

Step 3: Calculate Your Payoff Time

- Click the “Calculate” button.

- The calculator will display an estimate of how many months it will take to pay off your debt.

- If your payment is too low to ever pay off the debt, the calculator will alert you to increase your monthly payment.

Example

- Debt Amount: $3081.96

- Interest Rate: 25.88%

- Monthly Payment: $100

- Extra Monthly Payment: $0

- One-Time Payment: $0

Click Calculate and it will calculate that you will pay off your debt in 52 months (4.3 years).

Tips for Faster Debt Payoff

- Increase your monthly payment to reduce interest.

- Make extra payments whenever possible.

- Use lump sums (like bonuses or tax refunds) for one-time extra payments.

Try different scenarios to see how extra payments can help you become debt-free faster!

A Friendly Note About Our Resources

While I’m passionate about helping you take control of your finances, I want to be clear that I’m not a financial advisor, consultant, or guru. The tools, calculators, and resources on this site are based on my personal experience and what has worked for me in my own financial journey.

Please use all resources, calculators, and downloadable items as guides to support your financial decisions, not as professional financial advice. Every financial situation is unique, and what works for one person may not work for another.

I encourage you to reach out if you have:

- Questions about how to use our tools

- Suggestions for making them more helpful

- Feedback about your experience

- Ideas for new resources

For major financial decisions, please consider consulting with a qualified financial professional who can provide advice tailored to your specific situation.

Your success matters to me, and I’m here to support your journey toward financial confidence!

Leave a Reply